All Categories

Featured

Table of Contents

At the end of the day you are purchasing an insurance item. We love the security that insurance coverage supplies, which can be acquired much less expensively from a low-cost term life insurance policy policy. Overdue car loans from the plan may additionally decrease your fatality advantage, decreasing one more degree of defense in the policy.

The idea only functions when you not just pay the significant costs, but make use of additional money to purchase paid-up additions. The chance expense of every one of those dollars is tremendous exceptionally so when you could instead be spending in a Roth Individual Retirement Account, HSA, or 401(k). Also when compared to a taxable investment account or also an interest-bearing account, boundless financial may not offer similar returns (compared to spending) and equivalent liquidity, gain access to, and low/no cost structure (contrasted to a high-yield financial savings account).

When it comes to economic planning, whole life insurance typically stands out as a popular option. While the concept might appear enticing, it's important to dig much deeper to understand what this actually indicates and why watching entire life insurance policy in this means can be misleading.

The idea of "being your very own financial institution" is appealing since it suggests a high level of control over your funds. This control can be illusory. Insurance business have the supreme say in just how your plan is managed, consisting of the terms of the lendings and the prices of return on your cash worth.

If you're taking into consideration entire life insurance, it's crucial to see it in a broader context. Entire life insurance policy can be a useful tool for estate planning, offering an assured fatality advantage to your recipients and potentially providing tax obligation benefits. It can also be a forced cost savings vehicle for those that have a hard time to conserve cash regularly.

It's a form of insurance policy with a savings component. While it can offer constant, low-risk growth of money worth, the returns are normally less than what you could achieve with various other financial investment automobiles (infinite income plan). Before leaping right into entire life insurance with the concept of limitless financial in mind, take the time to consider your financial goals, threat resistance, and the full range of financial items offered to you

Infinite Banking Definition

Boundless financial is not an economic cure all. While it can operate in particular circumstances, it's not without risks, and it calls for a considerable dedication and understanding to take care of successfully. By recognizing the potential pitfalls and understanding real nature of entire life insurance policy, you'll be better geared up to make an educated choice that sustains your financial wellness.

This publication will instruct you just how to establish a financial plan and exactly how to make use of the banking plan to invest in realty.

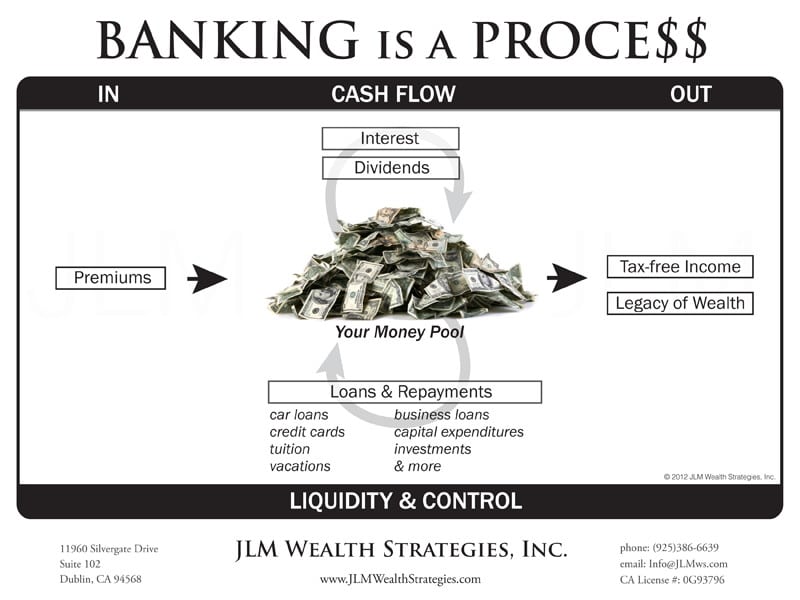

Unlimited financial is not a product or solution offered by a details organization. Boundless banking is an approach in which you purchase a life insurance policy plan that builds up interest-earning cash money worth and obtain lendings against it, "borrowing from on your own" as a source of resources. After that eventually repay the lending and start the cycle all over once again.

Pay policy costs, a portion of which constructs cash money worth. Take a finance out against the plan's cash worth, tax-free. If you utilize this idea as intended, you're taking money out of your life insurance plan to purchase everything you would certainly need for the rest of your life.

The are entire life insurance coverage and universal life insurance policy. expands cash value at a guaranteed rates of interest and also through non-guaranteed returns. grows money value at a dealt with or variable rate, depending upon the insurance provider and policy terms. The cash value is not contributed to the survivor benefit. Cash money value is an attribute you make use of while to life.

The policy car loan passion rate is 6%. Going this path, the passion he pays goes back into his policy's cash money worth instead of a financial organization.

Banking With Life

The idea of Infinite Financial was created by Nelson Nash in the 1980s. Nash was a finance expert and follower of the Austrian institution of economics, which promotes that the worth of goods aren't explicitly the result of traditional economic structures like supply and need. Instead, individuals value cash and goods in a different way based upon their economic standing and needs.

One of the mistakes of conventional financial, according to Nash, was high-interest rates on loans. Also lots of individuals, himself consisted of, obtained into financial trouble as a result of reliance on financial establishments. Long as banks set the passion rates and financing terms, individuals didn't have control over their own wealth. Becoming your very own banker, Nash figured out, would put you in control over your monetary future.

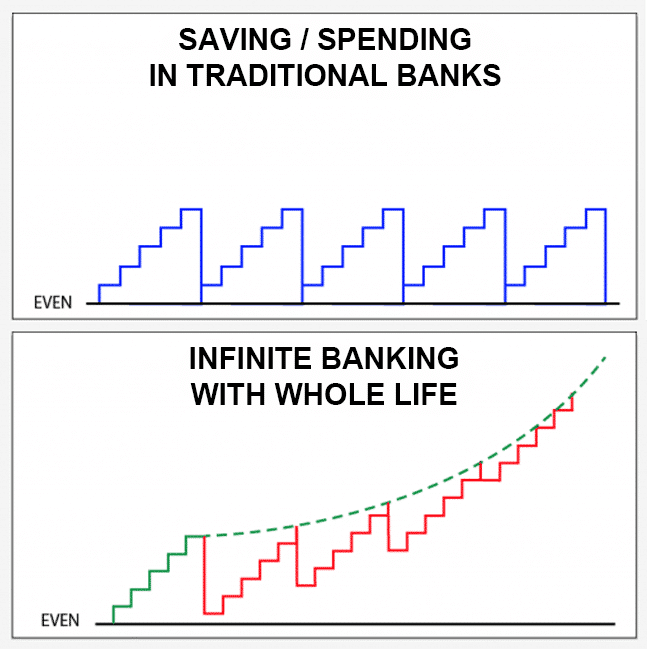

Infinite Financial needs you to own your economic future. For goal-oriented individuals, it can be the finest economic device ever. Here are the benefits of Infinite Banking: Perhaps the solitary most advantageous aspect of Infinite Banking is that it boosts your money circulation.

Dividend-paying entire life insurance policy is very reduced danger and offers you, the insurance holder, a good deal of control. The control that Infinite Financial provides can best be organized into two groups: tax obligation benefits and possession defenses. One of the reasons whole life insurance coverage is excellent for Infinite Banking is how it's strained.

When you make use of whole life insurance policy for Infinite Banking, you get in right into a personal agreement in between you and your insurance coverage business. These securities may vary from state to state, they can include security from property searches and seizures, defense from judgements and security from lenders.

Entire life insurance coverage policies are non-correlated properties. This is why they function so well as the monetary structure of Infinite Banking. Regardless of what happens in the market (stock, genuine estate, or otherwise), your insurance plan maintains its well worth.

Infinite Banking Center

Entire life insurance policy is that 3rd pail. Not just is the rate of return on your entire life insurance coverage policy assured, your death advantage and premiums are also assured.

Below are its major advantages: Liquidity and access: Policy lendings give instant accessibility to funds without the constraints of standard bank fundings. Tax effectiveness: The cash money value grows tax-deferred, and plan finances are tax-free, making it a tax-efficient device for building riches.

Property defense: In lots of states, the cash worth of life insurance policy is secured from lenders, including an extra layer of economic protection. While Infinite Banking has its values, it isn't a one-size-fits-all remedy, and it features substantial downsides. Here's why it might not be the most effective strategy: Infinite Banking frequently needs complex plan structuring, which can perplex insurance policy holders.

Picture never having to worry concerning financial institution car loans or high interest rates once again. That's the power of infinite financial life insurance coverage.

There's no set funding term, and you have the flexibility to select the payment schedule, which can be as leisurely as paying back the finance at the time of fatality. This versatility extends to the servicing of the fundings, where you can select interest-only payments, keeping the lending balance level and manageable.

Holding cash in an IUL repaired account being attributed interest can frequently be much better than holding the cash money on down payment at a bank.: You've constantly desired for opening your own bakery. You can obtain from your IUL policy to cover the preliminary costs of leasing a space, acquiring devices, and employing team.

Infinite Banking Videos

Individual loans can be acquired from typical financial institutions and credit report unions. Obtaining money on a credit card is generally extremely expensive with yearly portion rates of rate of interest (APR) usually getting to 20% to 30% or even more a year.

The tax obligation treatment of plan fundings can differ dramatically relying on your nation of house and the specific regards to your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy fundings are usually tax-free, supplying a significant advantage. Nevertheless, in other territories, there may be tax implications to consider, such as potential taxes on the car loan.

Term life insurance coverage just gives a death advantage, without any type of cash money value accumulation. This means there's no cash value to obtain against.

Nevertheless, for lending policemans, the considerable laws imposed by the CFPB can be seen as difficult and restrictive. First, loan police officers commonly argue that the CFPB's regulations produce unnecessary bureaucracy, leading to even more documentation and slower funding handling. Rules like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) needs, while focused on securing consumers, can bring about hold-ups in closing offers and boosted functional expenses.

Table of Contents

Latest Posts

Direct Recognition Whole Life

Bank On Yourself Plan

Be Your Own Bank Series

More

Latest Posts

Direct Recognition Whole Life

Bank On Yourself Plan

Be Your Own Bank Series