All Categories

Featured

Table of Contents

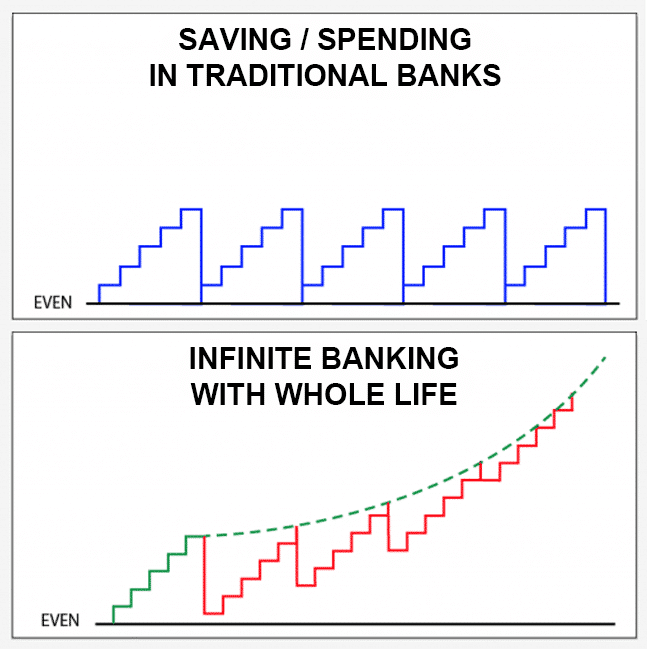

For a lot of individuals, the most significant issue with the infinite financial idea is that preliminary hit to very early liquidity triggered by the costs. Although this disadvantage of limitless financial can be minimized significantly with appropriate plan style, the very first years will certainly constantly be the most awful years with any type of Whole Life policy.

That stated, there are specific limitless banking life insurance policy plans made mainly for high very early cash worth (HECV) of over 90% in the very first year. Nonetheless, the lasting performance will frequently considerably delay the best-performing Infinite Banking life insurance plans. Having access to that added four figures in the first few years might come at the price of 6-figures later on.

You really obtain some considerable lasting benefits that help you recoup these very early expenses and after that some. We locate that this impeded very early liquidity problem with unlimited banking is extra psychological than anything else once extensively discovered. If they absolutely needed every penny of the cash missing out on from their limitless financial life insurance coverage policy in the first few years.

Tag: boundless banking idea In this episode, I speak about funds with Mary Jo Irmen that teaches the Infinite Financial Concept. This topic may be questionable, yet I intend to get diverse views on the show and discover different strategies for ranch economic management. A few of you may concur and others won't, however Mary Jo brings a really... With the surge of TikTok as an information-sharing system, financial guidance and methods have found an unique way of spreading. One such method that has actually been making the rounds is the infinite banking concept, or IBC for brief, amassing endorsements from celebs like rapper Waka Flocka Fire. While the method is currently prominent, its origins map back to the 1980s when financial expert Nelson Nash introduced it to the world.

Within these plans, the cash money value expands based on a rate set by the insurance firm. Once a considerable money worth collects, insurance holders can acquire a money value loan. These lendings differ from standard ones, with life insurance policy working as collateral, suggesting one might shed their coverage if borrowing exceedingly without ample money value to sustain the insurance coverage costs.

And while the appeal of these plans is evident, there are inherent limitations and threats, necessitating persistent cash money value surveillance. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, specifically those utilizing strategies like company-owned life insurance (COLI), the benefits of tax breaks and compound growth can be appealing.

Infinite Banking Testimonials

The attraction of boundless financial doesn't negate its challenges: Expense: The foundational need, a long-term life insurance policy policy, is costlier than its term counterparts. Qualification: Not everyone gets entire life insurance policy due to strenuous underwriting procedures that can omit those with details wellness or lifestyle conditions. Intricacy and risk: The detailed nature of IBC, combined with its threats, may deter many, especially when simpler and less high-risk choices are available.

Assigning around 10% of your monthly revenue to the policy is just not feasible for many people. Utilizing life insurance as a financial investment and liquidity resource calls for technique and tracking of plan cash money value. Seek advice from a financial expert to figure out if infinite banking aligns with your concerns. Component of what you review below is simply a reiteration of what has already been stated over.

So prior to you get yourself right into a situation you're not prepared for, know the following initially: Although the concept is generally offered thus, you're not actually taking a lending from yourself. If that held true, you wouldn't need to settle it. Rather, you're borrowing from the insurance firm and have to repay it with rate of interest.

Some social media blog posts recommend making use of money value from whole life insurance policy to pay down credit history card financial obligation. When you pay back the car loan, a portion of that interest goes to the insurance coverage business.

For the first numerous years, you'll be paying off the payment. This makes it very difficult for your plan to build up value throughout this time. Unless you can manage to pay a couple of to numerous hundred bucks for the following years or more, IBC will not function for you.

Become Your Own Bank Whole Life Insurance

If you require life insurance coverage, right here are some valuable pointers to consider: Take into consideration term life insurance. Make sure to go shopping about for the ideal rate.

Copyright (c) 2023, Intercom, Inc. () with Booked Typeface Name "Montserrat". This Typeface Software is licensed under the SIL Open Up Font Certificate, Version 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Font Style Call "Montserrat". This Typeface Software application is licensed under the SIL Open Typeface License, Version 1.1.Miss to major web content

Self Banking Whole Life Insurance

As a CPA focusing on property investing, I've brushed shoulders with the "Infinite Financial Idea" (IBC) much more times than I can count. I have actually even talked to professionals on the topic. The main draw, aside from the apparent life insurance policy advantages, was always the idea of developing money worth within a permanent life insurance policy policy and borrowing against it.

Sure, that makes sense. Honestly, I always assumed that money would certainly be better invested straight on investments rather than channeling it through a life insurance policy Up until I discovered just how IBC can be incorporated with an Irrevocable Life Insurance Coverage Depend On (ILIT) to develop generational riches. Allow's start with the essentials.

Become Your Own Banker Whole Life Insurance

When you obtain versus your policy's cash value, there's no set settlement timetable, giving you the flexibility to manage the loan on your terms. At the same time, the cash money worth proceeds to grow based on the policy's assurances and rewards. This setup enables you to access liquidity without interfering with the long-lasting growth of your plan, offered that the lending and interest are taken care of wisely.

The process continues with future generations. As grandchildren are birthed and expand up, the ILIT can purchase life insurance coverage policies on their lives. The trust after that builds up numerous plans, each with growing cash worths and fatality benefits. With these plans in place, the ILIT effectively ends up being a "Family Financial institution." Member of the family can take loans from the ILIT, making use of the money worth of the policies to money investments, start organizations, or cover major expenses.

A vital element of managing this Family Bank is using the HEMS requirement, which represents "Health, Education And Learning, Upkeep, or Support." This guideline is typically consisted of in trust fund contracts to guide the trustee on exactly how they can distribute funds to beneficiaries. By adhering to the HEMS criterion, the count on makes sure that circulations are made for crucial requirements and long-lasting assistance, securing the trust's properties while still attending to household members.

Boosted Versatility: Unlike rigid bank car loans, you regulate the payment terms when obtaining from your very own policy. This allows you to structure settlements in a manner that lines up with your service money circulation. what is infinite banking life insurance. Better Cash Money Circulation: By financing overhead via plan car loans, you can potentially liberate cash money that would certainly otherwise be tied up in traditional loan payments or tools leases

He has the same tools, but has actually also developed additional cash value in his plan and got tax obligation benefits. And also, he currently has $50,000 readily available in his plan to utilize for future possibilities or costs., it's crucial to see it as more than simply life insurance policy.

Infinite Banking Illustration

It has to do with producing a versatile financing system that gives you control and gives several advantages. When made use of tactically, it can complement other investments and business methods. If you're intrigued by the possibility of the Infinite Financial Concept for your service, right here are some actions to consider: Educate Yourself: Dive deeper into the idea via trusted books, workshops, or appointments with well-informed specialists.

Table of Contents

Latest Posts

Direct Recognition Whole Life

Bank On Yourself Plan

Be Your Own Bank Series

More

Latest Posts

Direct Recognition Whole Life

Bank On Yourself Plan

Be Your Own Bank Series